APPENDIX B

The co-operative model business plan

This appendix provides a model business plan outline. Make the plan your own. Your cooperative is unique in many ways so you don’t want the business plan to look just like everyone else’s; you want it to be an expression of your co-operative’s unique structure, products, plans, principles, values, environment and people.

Cover page

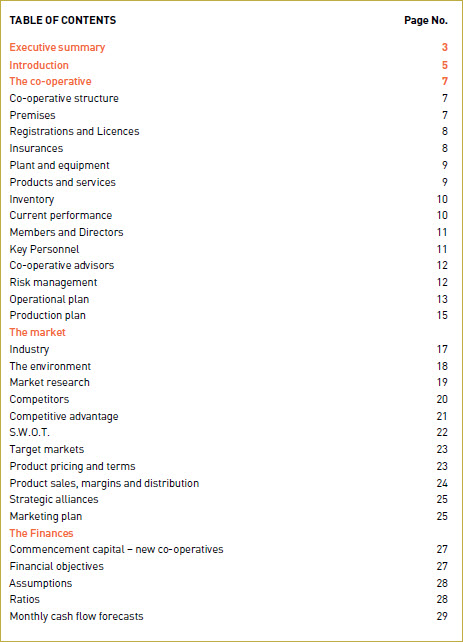

The business plan itself does not need to have all the sections listed in the Table of Contents below, but you should put some effort into every section listed in it to have the co-operative well prepared before it is open for business.

Following the title page, the business plan should, at a minimum, have an executive summary, co-operative overview, market analysis, and plans for marketing, operations, production and finances.

Contents

Executive summary

Write the executive summary after you have finished the rest of the business plan. It’s an overview of the business plan, highlighting the main points and putting them into context. Consider organising the executive summary in the same order as the business plan.

The executive summary is placed at the start of the business plan to entice the reader to read the entire business plan, making it one of the most important sections.

It is not new information; it is a summary of information which is discussed in more depth throughout the business plan.

The executive summary should be able to stand on its own, and succinctly explain in one or two pages the distinctive characteristics of the co-operative and its products and why it will be successful.

It may include:

- the reason(s) the business plan has been written

- an overview of the co-operative and its market opportunities

- a description of the products or services

- a summary of its expected financial performance.

Complete it with conclusions and recommendations and a summary of how you’ve arrived at your conclusions.

Another way of looking at what the executive summary says is: What is the problem? What is the solution? What will be the outcomes?

Introduction

This section provides background information about the co-operative and could very briefly describe the co-operative type, when it was formed, who formed it and why, its location, mission, vision, values and principles, objectives and strategy to achieve them, industry, products and services, target market, development stage and achievements to date, summary of members and management, and capital raised to date.

The mission statement should say what you do, how you do it, and why you do it.

The vision statement should be somewhat loftier – describing what you want the co-operative to be in the long-term; it should be a “planned wish”.

The objectives state what the co-operative wants to achieve, usually within a certain timeframe, and are guided by the mission and vision. Objectives are business, social and financial objectives. They should be measurable, and there should be both short-term and long-term goals.

Values are statements about why the co-operative is in business, and who it serves. Values consider the social and environmental factors which the co-operative will be mindful of in achieving its objectives.

The introduction may also explain why the business plan is being written, and for whom. If it is written to support an application for finance include the name of the bank or other financier, the amount of funding sought, the term of the loan, the use of the loan, how it will be repaid, and the security the co-operative will provide.

Make it brief; one to two pages should do.

The co-operative

Co-operative structure

Outline the co-operative’s structure. Remember that many people do not understand the democratic and social principles of co-operatives, so briefly explain how it works, its rules, and how it will support your business and social objectives.

Premises

Describe the location, size and capacity of premises and any warehouse facilities. If the premises are leased state the cost of rent and length of the lease; if they have been purchased, state the value of the property. Explain how long the co-operative has been at the premises, if there is a strategic advantage in its location and, if any renovations or extensions are required, what they will cost.

Registrations and licences

List the registrations and licences that the co-operative has. If others are needed, explain what they are and when they will obtained.

Insurance

Describe the insurance that the co-operative has and will be getting. It could include cover for premises, contents, workers’ compensation, liability, professional indemnity, business interruption, and motor vehicles.

Plant and equipment

Itemise the plant and equipment that the co-operative has and needs. If the business plan supports an application for funds, explain the importance of acquiring the equipment and provide details of quotes for their supply and installation. Consider listing the equipment in two tables: the first table showing the equipment already acquired and its cost and written down value; the second table listing equipment to be acquired, its value and when it is planned to be purchased or leased.

Products and services

In simple terms, describe the features of the products and services the co-operative currently provides, and those to be developed in the future. You may like to include photographs. Explain how they are different to others available in the marketplace, and why customers will buy products or services from your co-operative instead of from a competitor.

Describe the key components or raw materials used in making products, where they come from, and whether there are any restrictions on supply or agreements with suppliers. If there are likely to be price fluctuations, you might explain how they will be dealt with. You may wish to explain if there is a backup supplier available.

If it’s a new product under development, explain the progress made in research, product design and development, what tests are required and have been done, and any regulations applicable or licences or approvals that are needed. List any intellectual property protection sought to avoid duplication by competitors. Provide a timetable.

If there has been product testing in the marketplace, explain the results. Describe plans to upgrade the product or service or increase the range on offer. Describe quality assurance controls to be instigated.

If the co-operative provides a service, explain what it is, why it is needed, and how it is or will be delivered, monitored and improved.

Inventory

If you have a product inventory, list the items in a table, or include an inventory list in the appendices.

You may wish to include here how you are going to minimise shrinkage of inventory due to theft, damage, loss or accounting errors.

Current performance

If the co-operative has already been trading, include a short summary of the co-operative’s turnover, gross profit and net profit for the current year and last year. More detailed information will be put into the financial section of the business plan. If the co-operative hasn’t begun trading yet, use the projected financial figures.

Members and directors

If the business plan is being written to assist you to ask for finance, use this section to show that the people who own and run the co-operative are competent and qualified. Give an overview of the number of members, active membership provisions, who the directors are, and the offices they hold.

Include a summary of their skills, qualifications, experience and industry knowledge. Consider including résumés in the appendices.

Key personnel

If you plan to engage employees or already have staff, list the positions, names (if already employed) and skills of employees, and whether their employment is full-time, part-time or casual. Résumés for managerial positions could be included in the appendices. If your cooperative is fairly large, draw an organisational chart which shows who reports to whom, and the positions they hold, and include it in the appendices.

Co-operative advisors

Include the business names and addresses of professional advisers who have helped to establish and grow the co-operative. These might be bankers, solicitors, financial advisors or planners, insurance agents, accountants, chambers of commerce, another co-operative or a co-operative peak body. This section shows that your co-operative is supported by a professional team.

Risk management

List the risks, in order of likelihood that they could occur, that the co-operative faces. State the impact the risk could have, how likely it is to occur, and what action you will take to prevent or minimise the risk to the co-operative. Key risks may include property damage, theft, electrical outages, pollution, legal liability, injury, loss of data, shifts in the economy, loss of customers, loss of suppliers, security, theft of copyright or inability to raise capital.

Operational plan

A new co-operative should explain how the co-operative will be run: the daily routines, people and functions that will make the co-operative run smoothly and successfully. Keep in mind the democratic nature of your co-operative and its social purpose; make it the focus of your actions. Directors and managers should use the operational plan to lead and inspire members and staff.

Break your operational plan down into actionable steps so it will easier to implement. Identify what each task is, who will do it, when it will be done by, and how you’ll know it has been done. Attention to detail will make the co-operative’s operations run more efficiently.

The operational plan might include ways in which you intend to devise and implement operating, accounting and management systems required for the first year of activities. Plan for staff selection and recruitment, duties and salary policies, performance monitoring, training, health and safety policies, technologies, record-keeping, banking, taxation, accounts payable and receivable, meeting legal obligations, finding suitable premises and office equipment, use of professionals, service to customers, orders and delivery management, promoting innovation, further research and development, meeting schedules, developing a co-operative culture, appropriate management style, working with members and directors, conflict resolution, compliance with regulations and inspections, and alliances with other co-operatives.

Existing co-operatives will need to consider many of the same issues, but have the advantage of having procedures already in place. They should develop an operational plan to improve the day-to-day operations of the co-operative, reduce overheads, plan for growth, alleviate risk and increase efficiency.

Production plan

The production plan will describe how the co-operative will manufacture, procure products or provide services, and provide the final product or service to customers.

It will describe:

- the complexity of the manufacturing

- the equipment and tools required

- the cost of raw materials and labour per unit

- the cost to produce a product or deliver a service

- the number of hours of production daily or weekly

- the number of units to be produced or the number of services to be delivered

- average selling price

- managing inventory levels

- forecast number of days stock is to be held

- cost control

- manufacturing staff requirements

- source and delivery partners and contract terms

- the time taken to produce the required stock levels

- environmental plans

- disposal of waste.

Quality assurance is crucial, whether the co-operative is providing a product or service. The co-operative relies on the loyalty of members and/or customers for repeat orders, so it needs to provide value for money and consistently high quality products or services. A strong quality assurance system will consider employee motivation and skills, standards and testing, feedback from customers, and minimising waste and product returns.

The market

This is an important section of the business plan, as it demonstrates that you have done your homework and it is likely that your product or service will be accepted by customers. There’s not much point in having a great product if you don’t have a market.

Much research is involved: you’ll need to understand who your customers will be, what will make them spend their money on your products or services, who your competitors are, what environmental factors could affect you, and how you are going to sell and promote your product or service. There are many places to go for information – try the Australian Bureau of Statistics, government departments, councils, Regional Development Australia, trade and professional associations, chambers of commerce and consumer organisations.

Industry

Find which ANZSIC code is used for your business. ANZSIC is used by the government to produce and analyse industry statistics. ANZSIC codes for all industries are found at www.abs.gov.au.

An industry sector contains a range of other businesses which supply similar services or products. Provide an overview of the industry sector the co-operative is in, such as the size, growth, key clients and markets, the largest providers, and demand and supply trends that affect the industry now, or may in the future. Describe any other relevant factors that drive the industry, such as innovation, regulations, seasons, financial and technical issues, distribution and supply and whether the industry is new or mature.

Provide a summary of where the co-operative is positioned within that industry, and its vulnerability to competition and trends.

The environment

Describe important trends and issues that could affect your co-operative’s operations and identify how you plan to deal with them.

Political

Issues may include changes of government, international relations and trade, employment, environment and competition regulations, taxation legislation, new policies and laws, consumer protection, and industrial relations.

Economic

Issues may include interest rates, government spending, consumer confidence, unemployment, exchange rates, inflation, national and state economic growth, global economic outlook, materials availability, import substitution and skills shortages.

Social

Issues may include demographics, education, standards of living, multiculturalism, housing availability, fashion, health awareness and income distribution.

Environmental

Issues may include environmental awareness, waste, pollution, energy, climate change and water.

Technological

Issues may include efficiencies, obsolescence, NBN, costs, savings, research, innovation and social networks.

Market research

It’s crucial to understand the marketplace and your customers, whether they are likely to buy the co-operative’s products or services, and possible ways to motivate them. There are two types of research you can do that will help with this: primary research, done by observing competitors, meeting with potential customers, or by survey; and secondary research, which is gathered from existing data.

What you will research will depend on what your products and services are, who your customers are, where your market is, and the level of competition in the marketplace.

Your market research might include:

- customer profiles and characteristics – age groups, gender, occupation, income, location, buying habits

- customer preferences, needs and expectations

- target markets

- the customer fit, and demand for products and services

- your fit, barriers to entry and influence on the market

- product specifications, acceptance and new opportunities

- product pricing and sales forecasts

- market size (units and value)

- market growth and trends

- market segmentation and definition

- competitor analysis

- advertising and promotional opportunities

- seasonal variations

- methods of distribution.

Describe the research you have done, and what it has revealed.

Competitors

Do not underestimate your competition. You need to understand and describe who your competitors are and the effects they will have on the co-operative’s business. Provide details of their market share, resources, products and target market, strategies, strengths and weaknesses.

Explain where the co-operative fits within the industry, what level of market share you expect, any barriers to entry and how you will address them.

Also describe how the competitors are likely to react at your co-operative’s entry into the market and the co-operative’s response strategy.

Competitive advantage

Describe what is different about your products or services compared to those of competitors. Explain why customers are likely to buy enough of your products or services to make the co-operative sustainable.

- Do you have a different target market?

- Is there an unmet need in the target market you can fulfil?

- Do you offer something different or new?

- Does your product or service have superior quality or features?

- Will the co-operative advantage work for you?

- If your product or service is unique, describe difficulties competitors will have in copying it, giving a lead time from product launch to when a competitor can duplicate your product.

S.W.O.T.

List the co-operative’s internal strengths and weaknesses.

Then list the external factors that could affect the co-operative’s activities – the opportunities (e.g. market trends) and threats (e.g. competitors, economic uncertainty).

Describe how you can capitalise on the strengths and opportunities, and reduce the effect of weaknesses and threats.

| Strengths | Weaknesses |

|---|---|

| Examples: – Strong memberships – Well balanced social and commercial objectives – Great customer service – Excellent location – Unique product or service | Examples: – Common product or service – Undertrained staff – Lack of capital – Underdeveloped systems – Inexperience |

| Opportunities | Threats |

| Examples: – Lack of competition – Competitor leaving market – New governmnt grant available – Improved economic conditions | Examples: – Strong competitiors – New regulations – New competitor entering the market – Poor exchange rate |

Target markets

Describe the target markets for your product or service. Who are your customers? If you already know who they are, list the major clients if they agree to this information being made available to external parties. If you don’t have major clients, or there are potentially many of them, you should define the markets you will be selling to.

How have you identified your target markets? What are the characteristics of the target markets? Are your customers a certain age or gender, do they live in a particular location, have a certain type of job, ethnicity or income level? Are they members of the co-operative? What are their needs and preferences? How big is your target market? How often will they buy from you? Why and how will they buy your product or service? Are they end-users?

Consider if there are different segments to your target market. For example, would both students and professionals buy your products? Each segment may have different needs, and may be willing to pay different prices. If you understand the needs of each segment, you can adapt your marketing mix to provide what each segment wants.

Product pricing and terms

In determining the prices of your products or services, consider the costs to produce, or to deliver services, your customers’ sensitivity to the price and to price changes, and what the price reveals about the product’s value or quality. Will you offer quantity discounts, or discounts for repeat sales? Will co-operative members receive a discount or rebate?

Describe the expected payment terms for customers, e.g. direct customers pay cash while distributors and members pay within 30 days from invoice date.

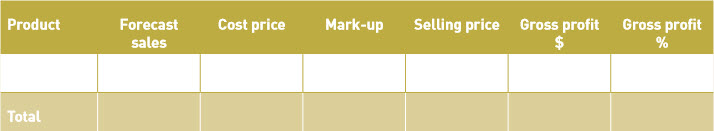

Product sales, margins and distribution

If your co-operative is new, estimate the number of products or services to be sold in the first year, and consider using a table to show your estimates. If the co-operative is already established, use both past and projected performance levels. You may wish to break the table down into weeks or months. The table can form the basis of sales volume records and pricing over time, and identify changes to help you to plan future sales targets and purchases of raw materials.

Describe how your products will be distributed – whether through direct sales, online marketing, direct mail, agents, wholesalers, representatives, retailers or consignments. Describe commissions or other fees involved.

Estimate the cost of other expenses such as shipping, warranties, contracts and liabilities.

Strategic alliances

List strategic partnerships the co-operative has, or plans to form, with other co-operatives or businesses.

These may be to work together in major ventures, or on market access, supplies or other resources. Provide information about the arrangements.

List key suppliers, and describe their history and reliability, location, what and how much they can supply, credit policy and delivery details, and the cost and availability of materials.

Marketing plan

Explain your marketing objectives – what you aim to achieve and what you will do to achieve them. Ensure they can be measured and evaluated. An example might be “to obtain 20% of market share by the end of the first year”, or “to ensure 50% of our target market recognise our brand, and 10% buy our products”. Then determine what marketing activities will help you achieve your aim.

Determine your marketing strategies and activities for each month of the first year to create awareness and sales. This is your marketing mix, and relates to product, place, price, promotion, people and process.

Product strategy: consider the products’ qualities, consistency, features, adaptability, packaging and design, how the customers will perceive the products’ features, and how you will market them.

Place strategy: consider distribution channels, location of retail outlets, the geographic area your products will be available in.

Price strategy: consider the selling price to various customers and markets, including discounts for quantity and early payment.

Promotion strategy: consider what advertising, selling, sales promotion, trade shows, website, media and public relations activities you will undertake to differentiate your product and make consumers aware of your product or service.

People strategy: consider who will sell the product and delivery it. People may include staff, strategic partners and agents.

Process strategy: this is the strategy where you plan, target, cost, develop, implement, document and review the systems to attain the other aspects of the marketing plan. You’ll plan to have the right product, in the right place, at the right price, in the right quantity, at the right time for the right customers.

The finances

Often the last part in the business plan, the finance section is important as it demonstrates the likely financial viability of the co-operative, and is vital information for anyone considering investing in the co-operative.

It shows what financial resources are needed to set up and operate the co-operative, forecasts of the co-operative’s performance based on expected sales levels, and it details the timing and the amount of investment needed from external sources.

Commencement capital – new co-operatives

List the amount of capital that has been raised and will be raised from members, and funding confirmed from other sources.

List the costs to start the co-operative (below) in a table, and show the month when the costs are expected to be paid.

- Set up the co-operative: these costs might include accounting and legal fees, registration of the co-operative and domain name, website, insurances and licences.

- Set up the premises: these costs might include a bond and advance rent, fit-out, electricity connection, telecommunications connections and stationery.

- Purchase plant and equipment: these costs might include machinery, tools, office furniture, vehicles, telecommunications, computers and software.

- Start of operations: these costs might include advertising, raw materials and supplies, wages, interest – and working capital to tide the co-operative over until it trades sustainably.

Subtract the set-up costs from the confirmed capital raised; the balance is the amount of borrowings you will require.

Financial objectives

List the co-operative’s financial objectives and how long you expect to take to achieve them. These may be profit targets, investment levels, returns to members and debt repayment.

Assumptions

Explain the key assumptions made in developing your financial forecasts:

- sales and purchases forecasts

- the time it will take to collect from debtors

- the time it will take to pay creditors

- interest rates

- time between manufacture and sale

- timing of member contributions

- timing of external capital injections

- increasing membership.

If the co-operative has already been trading, describe its financial history, including equity, debt and profit levels.

Ratios

Include at least four key financial ratios:

- Debt equity ratio = total liabilities/members’ equity

- Return on investment = % of interest over total loans received, and % dividend over members’ capital injected

- Break-even point = the sales volume level where revenues and expenses are equal and provide no profit or loss. This will change each year with changes in costs, income, and interest levels.

- Working capital = current assets – current liabilities

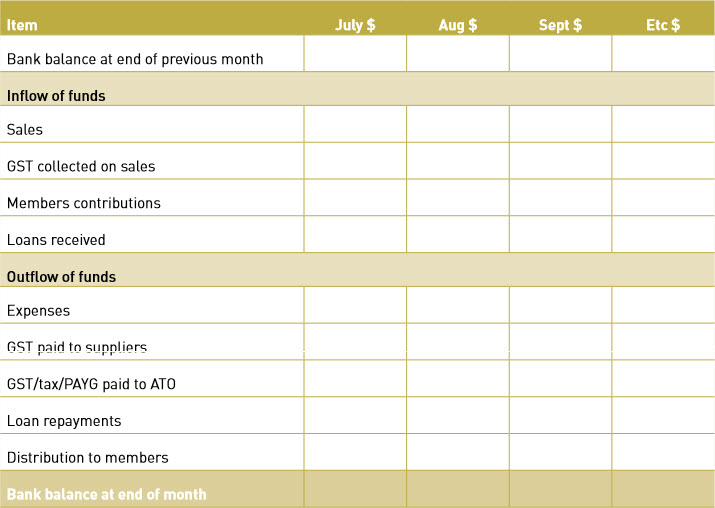

Monthly cash flow forecasts

The cash flow forecast demonstrates how and when cash comes into and goes out of the co-operative. Hopefully it also shows that income from sales will pay for bank loan repayments and other expenses. It will show you when you need an injection of cash to cover monthly bills, and when you need to conserve cash to pay for upcoming bills.

For the first year of trading, present monthly cash flow forecasts. After the first year, show yearly forecasts for at least two years.

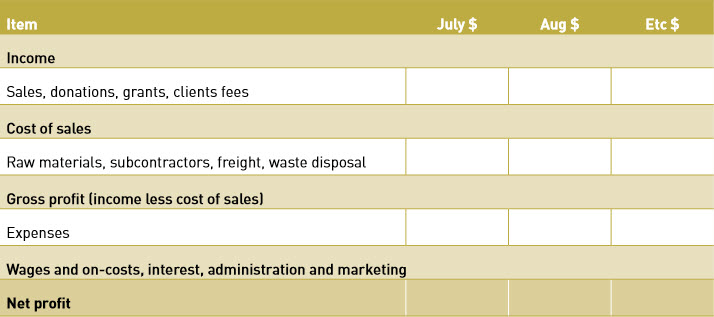

Monthly income and expenditure forecasts

Also called profit and loss forecasts, and forecasts of financial performance, income and expenditure forecasts show the co-operative’s projected income less expenditure, resulting in a profit (or loss) over a specific period of time. For the first year of trading, provide monthly or quarterly forecasts, and annually for the following two years.

Just a few quick tips for the financially challenged – income is usually from sales, and expenditure is usually the costs to run the co-operative and interest payments. Loans (liabilities), purchased equipment and inventory (assets), capital injections from members (equity) are all items for the balance sheet.

When you receive an invoice it is an expense, even if you haven’t paid it yet; so it is shown in the month the expense was incurred. Show all items as GST exclusive (i.e. without GST).

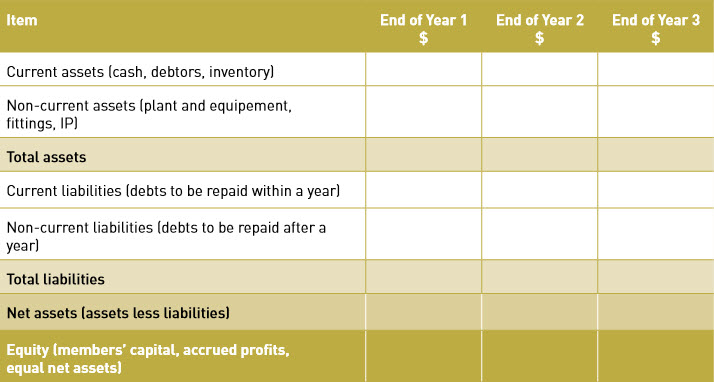

Balance sheet forecasts

The balance sheet, also known as the statement of financial position, shows the co-operative’s net worth at a particular point in time – usually the last day of the financial year. Assets are usually objects and cash the business owns, liabilities are usually debts owed, and equity is the capital contribution and accrued profits. Assets minus liabilities equals equity.

Provide balance sheet forecasts for three years.

Financial plan

Describe your plans for the co-operative’s financial viability. What is the total investment required for start-up? What are your short and medium-term investment plans? Where will funds come from? Have they been confirmed? How much comes from each source, and what conditions do funds come under (e.g. interest rates, repayment terms)? What security is offered?

When is the co-operative expected to make a profit? What level of sales is required to make a profit? When will members see a return? How much are profits expected to grow each year? How will costs be kept down? If non-distributing, will you retain surpluses, and where do you plan to donate excess surpluses?

Do you have an exit strategy?

A note on financial management

This note on financial management is not meant for inclusion in the business plan, but nevertheless is very important. (A summary of the financial management systems used could be included in the financial plan.)

Members (and investors) need to know how the co-operative is performing and need to receive regular accurate reports. Systems must correctly identify, measure and communicate financial information.

You need to understand and abide by accounting principles.

Complete, accurate, and up-to-date financial records must be kept. These may be handwritten, or on computer spreadsheets, but we recommend that unless the co-operative is very small, you should use financial software. Such software doesn’t replace an accountant, but usually knows what to debit and credit, and has a useful help function.

Develop strong systems for handling cash. Provide numbered and dated receipts for money received. Provide numbered and dated invoices (tax invoices if the co-operative is GST registered) for purchases and to others who owe you money.

Every month, reconcile your expenses paid and income received with the bank statement. Produce a balance sheet and profit and loss statement to help you keep an eye on finances and to allow you to plan and control the co-operative.

Watch your creditor and debtor levels; ensure you collect money owing and pay expenses when due.

The strategic plan

A strategic plan is usually a long-term plan for the next three to five years. It explains the goals and objectives to be reached, and the path to achieve them. It’s a bit like a GPS for a very long journey, if you zoom out and ignore the minor roads.

Focus on a small number of key priorities. Too many priorities will mean you lose focus on the major objectives.

Make the priorities easy to translate into action plans, and have clear timelines to achieve outcomes.

Appendices

Information that might distract from the business plan’s flow should be included as appendices. Provide a summary of the information within the business plan, and more detail in the appendices. It’s also a good place to include information that is not part of the business plan. Start a new page for each appendix.

Appendices might include the following:

- Disclosure statement.

- Co-operative rules.

- Past three years’ financial statements.

- Directors’ and key staff members’ résumés.

- Pictures of products, premises or location.

- Forecasts of purchases and payments to creditors.

- Forecasts of sales and debtor collections.

- Letters of support.

- Promotional materials.