PART TWO: FORMING A CO-OPERATIVE

More on registrations – and the tax man

Business Name

The business name differentiates the co-operative from other businesses and identifies it to its customers, enabling them to make an emotional connection to the co-operative. A co-operative only needs to register a business name with Australian Securities and Investment Commission (ASIC) if it wishes to conduct its business or a particular undertaking under a name different to its registered name.

The business name can be registered rather quickly online with ASIC at www.asic.gov.au. You can check online to see if a name is available for registration or if it is identical or similar to a registered trademark. You may also check with ASIC to see if there are any state or territory licences you may need to use a name or operate a particular type of usiness.

To register a business name, enter the co-operative’s ABN, proposed business name, registration period and co-operative details. Confirm eligibility to hold a business name, and submit. That’s it – except for the fee.

A .coop domain name is the most cost effective way to let people know you are a co-operative. You can check to see if .coop domain names are available at domains.coop.

ABN and TFN

All trading entities are required to register for an Australian Business Number (ABN), which is a number that identifies the entity and is used when dealing with other businesses and the government. Having an ABN will make it easier to register for GST and other tax registrations. You can apply for an ABN and a Tax File Number (TFN) online at www.abr.gov.au.

The ABN application form will also allow you to register for GST and PAYG withholding at the same time.

GST

The goods and services tax (GST) is a tax on consumption that is charged on the supply of both goods and services. GST, currently 10% of the sale value, is charged by the supplier on most goods and services and regularly remitted to the Australian Taxation Office (ATO).

On the same application form as ABN registration, in most circumstances the co-operative may choose not to register for GST if it has a GST turnover of less than $75,000, or $150,000 for not-for-profit organisations. It is mandatory for entities with higher turnovers to be registered for GST.

Being registered for GST means that the co-operative needs to issue tax invoices and keep records of GST it charges its customers and GST it pays to suppliers, and submit a Business Activity Statement (BAS) quarterly to the ATO, or monthly if the entity has a high turnover. If the GST collected is more than the GST paid, the entity pays the difference to the ATO when the BAS is due. If the GST paid is higher than the GST collected, the entity receives a refund from the ATO.

Not all supplies are subject to GST. Many health supplies and foods are GST free. More information is available at www.ato.gov.au.

When an entity with a turnover below the threshold elects not to be GST registered, it does not collect GST from customers but still pays it to suppliers, and does not need to submit a BAS. Reducing paperwork may suit a small co-operative, at the cost of not being able to claim the GST paid, except as a tax deduction if the co-operative pays tax.

Income tax

For-profit co-operatives will need to pay income tax on a percentage of their profits. Budgeting for the total amount of income tax you are likely to pay is especially important in the first year of trading, as the co-operative will not pay income tax until sometime after the end of the financial year. The co-operative may elect to make voluntary payments to the ATO throughout the year, or retain the expected tax amount in a bank account until due. You can use the ATO’s tax tables to work out how much tax you will need to put aside.

Not all not-for-profit co-operatives are exempt from paying income tax; commercial activities that do not directly further a not-for-profit’s altruistic purposes may be taxable and not have access to tax exemptions, rebates and concessions in relation to those activities. The ATO’s website provides information and a checklist to help you determine if your co-operative and its activities are tax exempt.

PAYG withholding

A co-operative will need to register for PAYG withholding when applying for an ABN if it makes payments it needs to withhold tax from, such as payments of wages to employees. The amount withheld from payments is reported on an activity statement or BAS and an annual payment summary statement.

FBT

A co-operative will need to register for Fringe Benefits Tax (FBT) if it provides benefits to employees which are liable for FBT. Some common fringe benefits are private use of a work car and paying private expenses for an employee or director. You may need to lodge an annual FBT return, pay instalments and submit FBT with activity statements. Many not-for-profit and charitable entities are entitled to rebates and exemptions from FBT. Check with the ATO.

Superannuation

If the co-operative has an employee or director who earns over $450 per month, it will need to pay a percentage of their ordinary time earnings into the employee’s or director’s superannuation fund. At the time of writing, the superannuation rate is 9.5% of ordinary time earnings. SuperStream is the way businesses must pay employee superannuation guarantee contributions. Go to www.ato.gov.au/super/superstream for details.

Not-for-profits and charities

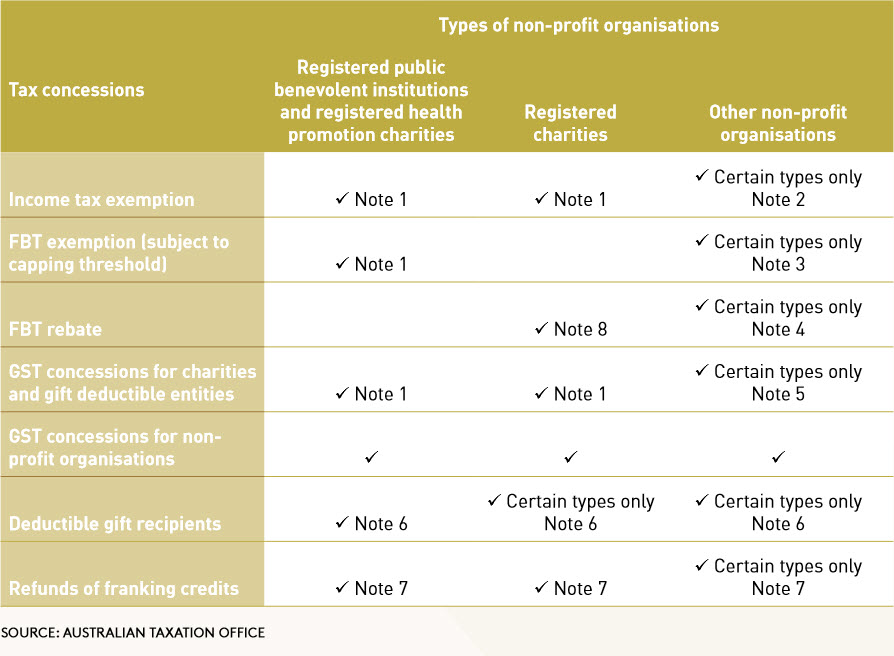

Non-distributing co-operatives are sometimes also registered as charities. Concessions are available from the ATO depending on what type of not-for-profit entity the co-operative is (see following table). Examples of charitable organisations are ones that promote health, provide community facilities (e.g. halls, migrant resource centres, community radio), promote art and culture, provide emergency services, relieve distress caused by natural disasters, provide social welfare (e.g. child care, counselling), assist the unemployed, advance scientific, commerce, agriculture or industry research, protect animals or preserve historic buildings.

Charities need to be registered by the Australian Charities and Not-for-profits Commission to be exempt from income tax. The ATO decides which entities are eligible for Commonwealth tax benefits and concessions. The online application form at www.acnc.gov.au can be used to register and apply for charity tax concessions and endorsement as a deductible gift recipient.

Summary of tax concessions for non-profit organisations as at May 2017

Notes to table

- The organisation must be endorsed by the ATO to access this concession

- Only certain types of non-profit organisations are exempt from income tax. Many non-profit organisations are taxable, but may be entitled to special rules for calculating taxable income, lodging income tax returns and special rates of tax.

- Public and non-profit hospitals and public ambulance services are eligible for this concession.

- Certain non-government non-profit organisations are eligible for this concession.

- The organisation must be a deductible gift recipient to access this concession.

- The organisation must be endorsed by the ATO as a deductible gift recipient to access this concession. The only organisations that do not need to be endorsed are those listed by name in tax law.

- The organisation must be an entity that is endorsed by the ATO as exempt from income tax or a deductible gift recipient to access this concession.

- The organisation must be endorsed by the ATO to access this concession. Not all registered charities are eligible for this concession.